Amplus Credit Income Fund July Commentary

Slow and steady wins the race. Senior Portfolio Manager, Andrew James Labbad, explains how investors are too focused on short term results. Amplus instead prioritizes adjusting the portfolio to better handle new market developments while still participating in the upside.

“The longer you can extend your time horizon, the less competitive the game becomes, because most of the world is engaged over a very short time frame.” —William Browne

As a father of two toddlers, our kids love bedtime stories. One of their favorites is The Tortoise and the Hare. We used to motivate them to get upstairs quickly by telling them whoever was fastest would win an elusive prize. They became so competitive that we now encourage them to slow down to avoid falling on the stairs and getting hurt (physically and emotionally). We remind them of the famous saying slow and steady wins the race. In the story, the hare brags about how fast he is and taunts the tortoise. Overconfident, he takes a nap mid-way through the race, which leads to his demise. Cooler heads prevail.

This tale applies well to investing. Building wealth over a lifetime does not require exceptional skills or Olympic style-sprints like the hare. It requires simple skills: a long-term approach, understanding risk-reward, prudence, and being aware of one’s skillsets. Discipline especially during times of volatility and irrational market moves is critical. Many investors are focused on short-term results, who then quickly fall behind and take outsized risks to catch up. Society’s constant pressure and media headlines portraying ‘get rich quick’ schemes make many question that investing is a marathon, not a sprint. So even though risk took a complete 180 degree turn in July, producing some of the best monthly returns in 2022, we remain focused on our long-term disciplined approach. With that said, Amplus participated in the upside while adjusting our portfolio to better handle some new market developments.

THE FUND

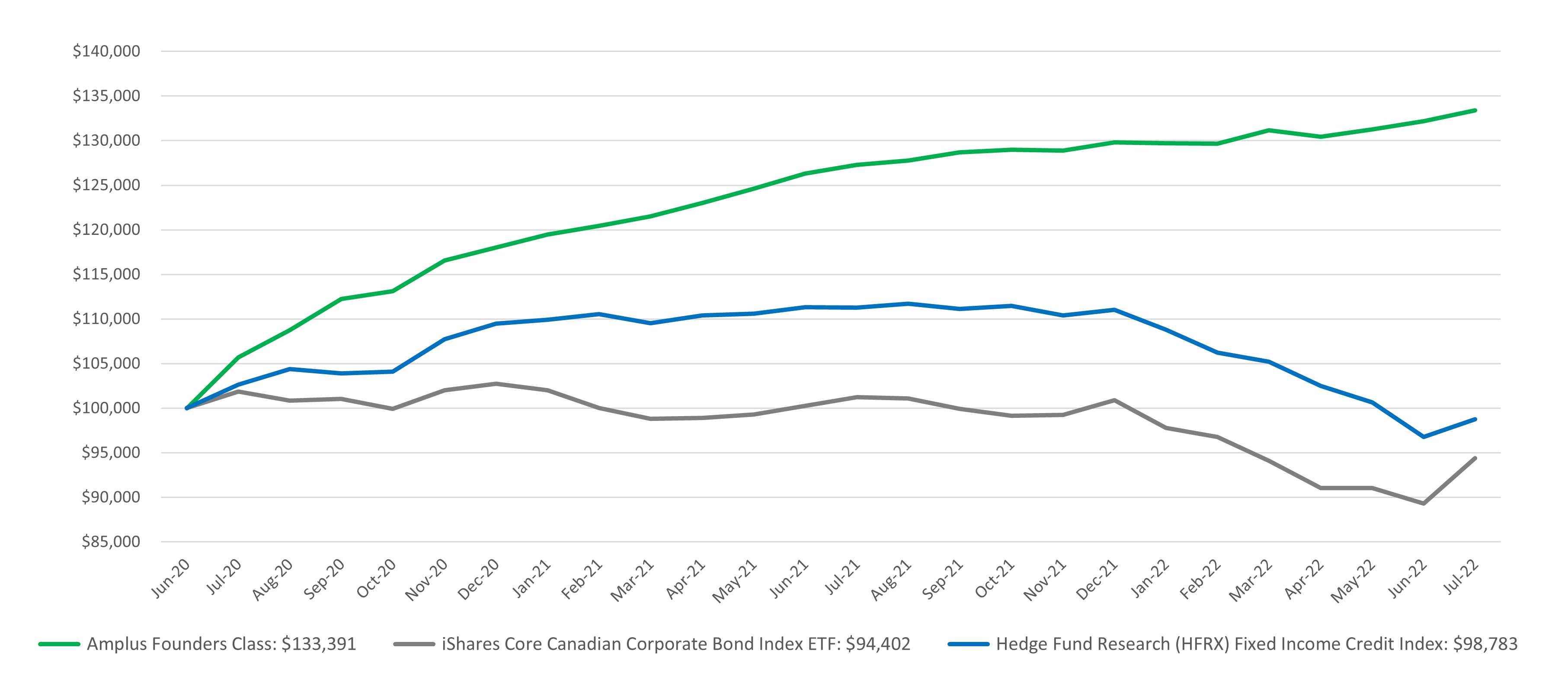

Our July performance was up +0.90%, with 2022 year-to-date growth of +2.75%. Despite a surprise 1.00% jumbo hike by the Bank of Canada, July saw fixed income indices up approximately 3.75% as rates rallied, and credit spreads compressed. As of July 31st, fixed income benchmarks year-to-date are still down generally over -7%. We spoke about positioning and sentiment as being extremely bearish in our last newsletter. With corporate earnings better than expected, inflation expectations peaking given weaker economic data and lower underlying energy prices, combined with a more dovish Fed policy interpretation at the latest FOMC meeting, markets got the long-awaited green light to go higher, erasing all of June’s losses. Credit spreads were on average 2bps tighter in Canada and 13bps tighter in the U.S.

GROWTH OF $100,000 INVESTED SINCE INCEPTION

Founders Class Series Performance

The fund outperformed overall credit spread tightening and finished with positive returns for the following reasons:

- Amplus benefits from a portfolio yielding over 8%, creating a larger margin of safety for market swings.

- Our overweight exposure to financials and energy producers generated positive gains with both sectors tightening 11bps and 9bps respectively.

- Shorter-dated bonds outperformed on the curve given the underlying curve inversion in treasury rates.

Our hedges did drag on overall performance, as volatility was subdued, and markets were one-way: higher.

GO FORWARD OUTLOOK

Even though risk took a turn for the better, we are very much aware of a few new dynamics at play:

First, the underlying treasury curve has inverted with 10yr rates trading 0.45% lower than 2yr rates, causing greater fears of a recession underway. This bodes well given our preference to own shorter dated bonds. Our portfolio is mostly invested in 1-3yr corporate securities, at greater all-in yields to their longer-dated counterparts. As this dynamic unfolds, we think credit spreads on short-dated bonds will outperform other maturities.

Secondly, we think Fed Chair Powell’s comments were viewed a bit too optimistically. Investors have become strangely optimistic that the Federal Reserve won’t have to tighten monetary policy much further, bidding up stocks and bonds amid hopes that the Federal Reserve will soon get inflation under control. To the market’s ignorance, the flood of Fedspeak, shortly after the FOMC meeting, had the clear markings of a deliberate and coordinated effort to correct that dovish interpretation. We took the misinterpretation as an opportunity to buy protection ‘on the cheap’, allowing us to participate in continued upside momentum while limiting any losses if markets were to interpret it our way.

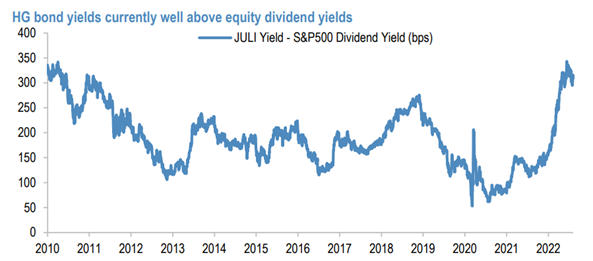

Finally, the yield on investment-grade (IG) bonds is currently well above equity dividend yields. As such, we see further tailwinds for fixed income as an assets class. Most recent fund flows in the U.S. seem to be confirming this with IG seeing its first net weekly inflow in 21 weeks, and high-yield funds seeing weekly inflows of $4.83bn and 2.93bn in the last two weeks, the largest weekly gain since November 2020.

We continue to see tremendous value in high-quality credit versus other asset classes. Historically wide credit spreads and elevated yields provide us with a large margin of safety. Our portfolio currently holds many companies that stand to benefit from elevated interest rates and strong commodity prices. We remain excited about credit and future return potential.