Silver Linings - Altius Minerals

With investor demands driving emphasis on sustainability, companies with ESG strategies may be impactful for shareholder value. Lions Bay Fund portfolio manager Justin Anis, CFA discusses his latest investment thesis.

Altius Minerals is a diversified mining, potash and renewable energy royalty business based out of St. John’s, Newfoundland. Altius boasts many of the characteristics we search for in a long-term investment: a strong management team, unique and competitively-advantaged business model that has the ability to grow through cyclical downturns, as well as shares trading at attractive valuations. As a long-held Wealhouse investment, we have written about Altius shares in the past, but felt it was necessary to provide an update on recent efforts by the management team to diversify their portfolio into a more Environmental, Social, and Governance (ESG)-friendly business through their renewable energy ventures. We believe this effort will be a meaningful catalyst for a re-rating in the shares as they execute on this strategy.

The management team at Altius Minerals has built a counter-cyclical business model that takes a contrarian approach to growing their portfolio of royalty assets and investments through the fullness of a business cycle. Throughout their 20+ year history, the management team has opportunistically acquired royalty streams on a diverse portfolio of assets during periods of distress in the mining space. They offer royalty financing to top tier operators of high-quality assets in exchange for long life royalties. Some examples of this are the Chapada copper mine operated by Lundin Mining, the 777 mines operated by Hudbay Minerals and various potash assets operated by Nutrien Inc. These royalty streams, amongst others, provide Altius with a predictable cash flow stream and exposure to upside in commodity prices and production expansion, without taking any development or operating risk themselves.

Over the history of the company, Altius has astutely deployed this cash during cyclical downturns to establish their project generation business, a portfolio of junior exploration projects which they spin out during cyclical upswings and fuel new royalty opportunities. This process has resulted in a business that has steadily grown revenues from $6 million in 2014 to $78 million in 2019 and driven operating cash flow from $3 million to $44 million over the same period. Management has also demonstrated a consistent track record of returning cash to shareholders through dividends and share buybacks. This track record and consistency are rare for a company with exposure to such cyclical end markets, which is why Altius is one of our preferred vehicles to gain exposure to commodity markets.

Our investors know that a strong management team is one of the most important things we look for when evaluating a long-term investment. Altius has a top tier management team with an exceptional CEO in Brian Dalton, who founded the company over twenty years ago and is the second largest shareholder in the company. We are in regular dialogue with Mr. Dalton and find his insights on the mining business and broader secular trends to be invaluable to our broader investment portfolio. Mr. Dalton has consistently adopted a unique and contrarian approach to building the portfolio of royalties at Altius, acquiring assets when they are out of favour and positioning the company to benefit from long term secular trends. The latest example of this is the establishment of a new subsidiary, Altius Renewable Royalties.

Altius has invested $100 million in renewable energy projects operating both solar and wind power generation.

Frustratingly, both for investors and for management, the share price of Altius has languished over the past few years despite management’s execution on their strategy and a steady growth in royalty revenue per share from $0.22 in 2014 to $1.84 in 2019. This disconnect between share price and fundamentals provides an opportunity for long term investors (and for Altius themselves, who have been aggressive in repurchasing stock). We think the discrepancy is likely explained by structural factors in the marketplace. Firstly, driven by the growth in passive investing, there has been a major shift in capital towards larger and more liquid companies. This is creating significant inefficiencies that can be exploited by nimble investment managers like Wealhouse. Secondly, as mentioned in the introduction, there has been a structural shift towards investments that meet ESG standards, as investors increasingly prioritize stakeholder values (such as environmental concerns) when making investment decisions. The nature of some of Altius’ legacy coal assets prevented the company from complying with certain ESG criteria, excluding the company from many investors’ purview.

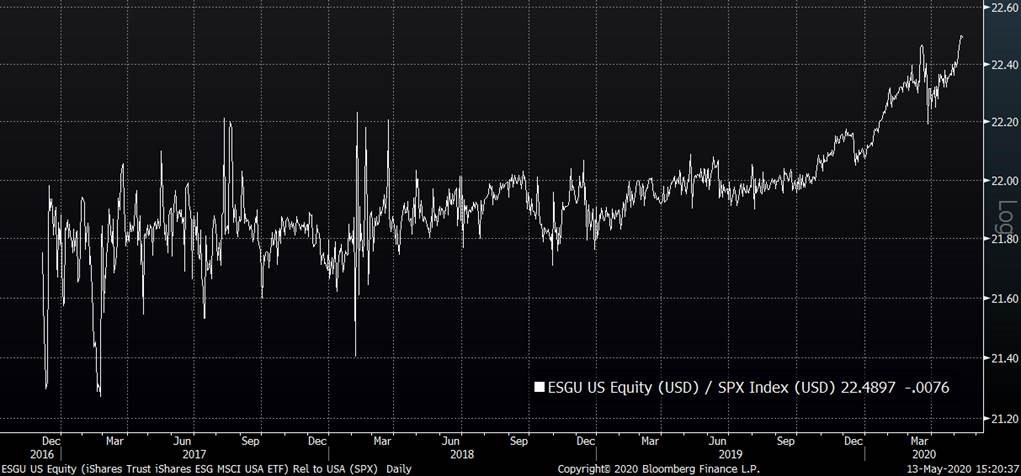

The chart below of the U.S. ESG Exchange Traded Fund relative to the S&P 500 highlights how powerful this trend is and how much capital is flowing into ESG investments. This presents a significant opportunity for Altius should the company successfully reposition itself.

U.S. ESG ETF Index Relative to S&P 500

Source: Bloomberg

Altius has responded to this opportunity with the formation of the aforementioned Altius Renewables Royalties (ARR) business. Management’s stated goal is to replace their coal revenues, which are phasing out, with renewable royalty revenues executed on long life renewable energy assets. Altius Renewables was formed in February 2019 after being initially conceptualised in Q1 2017. Since then, Altius has invested $100 million in renewable energy projects operating both solar and wind power generation. Based on comparable renewable companies, we expect ARR to trade at a material premium to the current trading multiple of the parent company, presenting a significant opportunity for shareholder value creation through a potential spin out. Importantly through the phasing out of coal assets and inclusion of renewable assets, Altius should be well positioned to benefit from the secular trend towards ESG investing.

We look forward to following the continued success of management as they execute on their strategy, and welcome the opportunity to continue to accumulate shares of a business whose trading price is so disconnected from the long-term fundamentals and near-term catalysts we see ahead.