A Closer Look at Market Breadth

The market selloff in September didn’t tell the whole story. In his latest commentary, Lions Bay portfolio manager Justin Anis, CFA explains why, despite the correction, recovery is looking alive. (And yes, he talks about the election too.)

For the third quarter of 2020, the Lions Bay Fund was up +5.3%. Year-to-date, the fund is up +5.2%. Our returns for the quarter were driven by strong gains in our core portfolio. Short-term trading profits were able to offset the small drag from our portfolio hedges during the quarter.

Our top performing investment for the quarter was Nike, which was up +28.3% over the period. Nike was able to deliver a stellar quarterly report in September fueled by a +83% growth in their digital business. The COVID-19 crisis provided an opportunity to showcase the investments Nike has made in their digital strategy, with the Nike App growth up +200% as customers sought innovative ways to exercise at home. This validates our belief that dominant consumer franchises and world class brands would continue to outperform during the pandemic; and that effective e-commerce platform and brand recognition would be more important than ever.

Our next two best performing investments, Apple and McDonalds, up +27.2% and +19.6% respectively, benefit from these same characteristics. While we have enjoyed outsized gains from these well-known large-cap companies during the depths of the crisis, we believe that substantial profits in future quarters will be realized from smaller businesses better able to leverage an economic recovery.

After expressing concern about crowding in technology stocks in the second quarter, we were pleased to see some of the froth come out of the NASDAQ in September, with the index declining by -11.7% over 21 days to start the month. Corrections like this tend to shake weak hands out of the market and are a healthy reminder of investment risk. Lions Bay was well positioned for this move and we were able to profit from the increase in volatility while subsequently taking advantage of the pullback to repurchase some of the names we had sold into the late summer melt-up. Episodes like these serve as good reminders of the value of active management, and the importance of being tactical.

Despite the violent moves in September, we believe the market is in a healthier place today than it was going into the month. While the correction was largely driven by mega-cap tech stocks which command tremendous influence over the indices, the “average” S&P 500 stock held up quite well. We are referring to the concept of market breadth, a measure we track closely when assessing market conditions. When outsized gains for the index are driven by a small number of very large companies, particularly when those companies operate in similar industries, we view index levels with a measure of skepticism. Conversely, when the price-weighted index declines but breadth remains firm, it is usually indicative of healthier market, since the “average” stock is still holding up. We measure this by looking at the S&P 500 Cumulative Advance-Decline (A/D) Line, which is generated daily by subtracting the number of declining securities from the number of advancing securities on the day, and adding that to the previous day’s level. The first chart below shows the S&P 500 while the second shows the A/D line. As readers can see, despite the S&P 500 struggling to reclaim new highs since the recent pullback, the A/D line has broken out to new highs. The average business is doing better than the S&P 500 index would indicate.

Source: Bloomberg

Source: Bloomberg

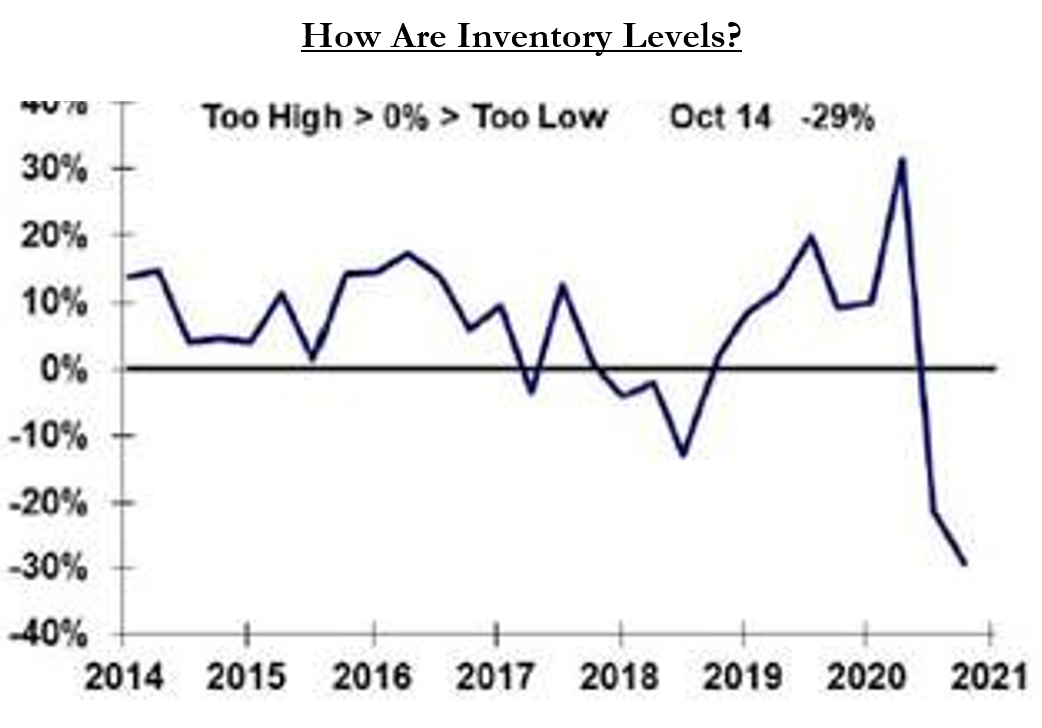

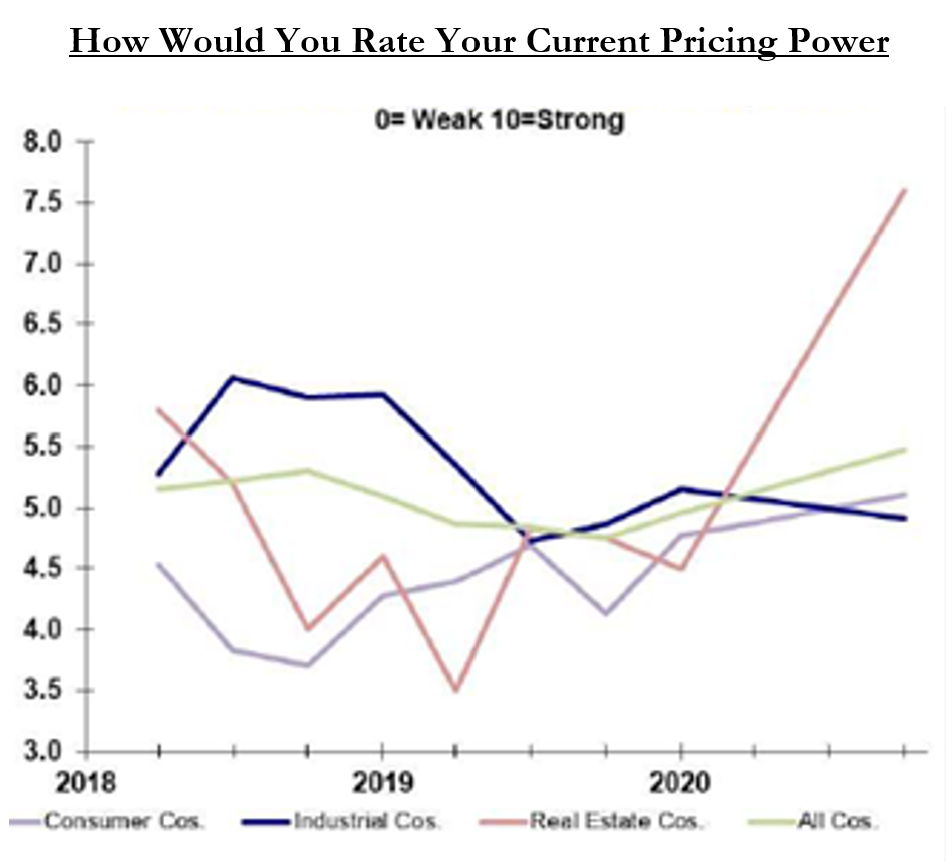

How should one interpret this expansion of market breadth? In our opinion, it is a welcome development that indicates that the market is beginning to believe that the economic recovery is taking hold. This fits with our earlier opinion that opportunity in quarters ahead will be driven by smaller businesses that are now catching up to the rebound in economic activity. In many cases, consumer demand came back more rapidly than businesses anticipated, yet due to the pandemic, many industries had to curtail production capacity for the safety of their employees. As the chart below illustrates, this has resulted in lower inventories, which in turn should result in both a restocking cycle and businesses having better go-forward pricing power. The below surveys from Evercore ISI Group support these conclusions.

We believe this recovery in cyclical earnings will lead to value stocks outperforming growth stocks over the medium term, and the chart below from Bank of America bears this out. Note that future earnings growth for the Russell 1000 Value Index (yellow line) now exceeds that of the Russell 1000 Growth Index (blue line) for the first time since 2009.

Source: FactSet, BoA US Equity & Quant Strategy

We have spent the summer buying smaller cap value stocks across a diverse range of industries that we feel have leverage to a cyclical recovery. We do not consider these “core” stocks, as our general definition of a core portfolio holding is a business that we want to own throughout a market cycle that possesses a conservative balance sheet and a balanced business model to grow and gain share through a downturn. We take large positions in these companies and hold them for a long time, and they make up the majority of our portfolio. As our readers know, we also have a transactional portfolio to take advantage of shorter-term trading opportunities in businesses that do not meet the criteria for a core holding yet present a compelling near-term risk reward. As a fund of our size, we have a competitive advantage over many of our larger competitors in that we can transact fluidly in these smaller businesses and take advantage of them as effective trading vehicles to express shorter-term views.

A recent investment example in such a business is JELD-WEN Holding Inc. JELD-WEN Holding Inc. is a building products company that is one of the world’s largest manufacturers of doors and windows with a $2.5 billion market capitalization. The company came to our attention in early July, when in a press release announcing the date of their upcoming earnings call, they provided an upbeat assessment of business conditions, with the CEO writing “June revenue improved significantly on a sequential basis to approximately flat with prior year, nicely ahead of our original expectations. June results benefited from the reopening of all our manufacturing facilities and improved demand in North America and Europe”. We took a small position in the mid-$16 range and over the coming weeks the company reported a strong Q2 in early August delivering margin expansion and raising guidance. In late September, the company pushed through 10-25% price increases for interior doors. Shares now trade above $24 and we anticipate that the company will continue to benefit from pricing discipline to take advantage of the strong housing market and continuing boom in residential remodelling and construction. Again, this is not a buy-and-hold-forever stock, but similar to trades in forestry stocks last quarter, we will continue to hunt for short-term opportunities in cyclical companies when the conditions line up.

Last but not least, we must dedicate some time to a discussion of the looming U.S. Presidential Election. At the time of writing, consensus seems to be building on Wall Street that we will get a “Blue Wave”. The market doesn’t seem as fussed by the prospect of a Biden administration as we would have anticipated at the start of the year. The economic fallout from the COVID-19 crisis has changed everything. We believe investors now assume that a Biden administration would lead to continued massive fiscal stimulus and that much feared tax hikes would be put off until at least 2022 when the economy is back on its feet. The market is addicted to stimulus, and we are likely to get it under either administration as President Trump continues to tweet on a daily basis that he wants a fiscal package larger even than the figure House Speaker Pelosi is seeking. Partisan politics will likely prevent the passage of any meaningful stimulus package before the election, but it will certainly be the first priority for either administration in the new year.

We do not believe that the market is appropriately discounting the risk of a contested election, which we view as the greatest risk to the market in the short-term. A contested election would get very ugly, and in addition to eroding faith in the democratic process, it would damage consumer sentiment into the holiday spending period. It would have dire implications for the economy and the stock market. Corporations usually take the year-end to formulate their budgets for the coming year and plan corporate strategy. They would not be able to do either effectively with Washington paralyzed. Major capital investments would be put on hold barring a definitive outcome. Even more troubling is that a market and populous that has become addicted to fiscal stimulus would not see any progress made on a fiscal package under such a scenario. It could be pushed back well into the first quarter of 2021 which could potentially derail the recovery. This would occur against the backdrop of a global economy grappling with increasing lockdown measures to combat a second wave of the virus. All of the uncertainties mentioned above may prolong the volatility that we have been experiencing as of late – an environment well suited to our investment strategy.

Reflecting on the volatility of 2020 and looking ahead at the potential risks facing us over the balance of the year, we are very grateful to have the toolset to both manage risk and protect downside during periods of market turmoil, while looking to capitalize on investment opportunities such environments present. We look forward to reporting to you again in the New Year and wish everyone a safe and a happy finish to the year. As always, please do not hesitate to reach out with questions, comments or ideas.