Amplus Fund October Update

Fixed income markets in October can be summarized by a spike in interest rate volatility led by rising inflation fears. Senior Portfolio Manager, Andrew James Labbad, shares his take on the recent price action.

“Inflation is the crabgrass in your savings.” – Robert Orben, American Entertainer

Last summer we had a crabgrass infestation in our yard. We tried everything to remove it; including pouring boiling water directly on the crabgrass, which ended up burning our healthy grass while the crabgrass remained intact. Every evening for weeks, we saw our neighbours manually removing each strand by hand. Despite all efforts, it was almost impossible to contain and it continued to spread like crazy. Similarly, inflation is rising, and central banks are having a hard time controlling it.

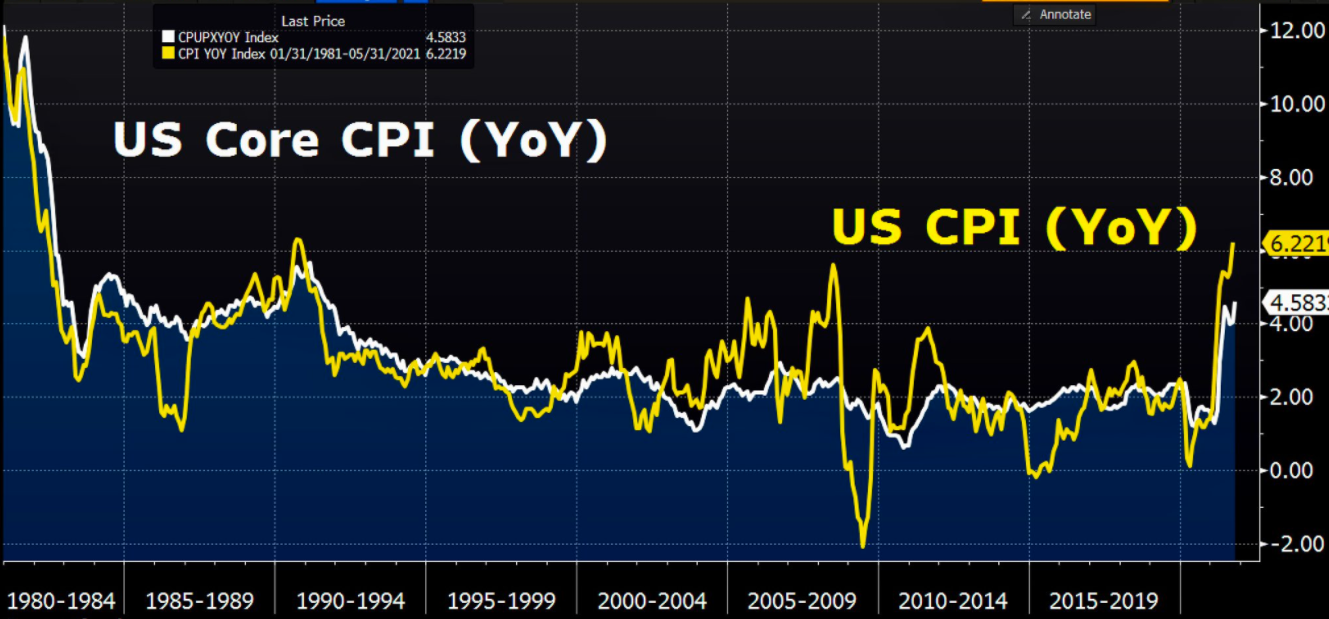

So far in 2021, global inflation rates for most major markets are 3-5% higher. Investors are faced with an increasingly difficult decision of leaving their hard-earned income in cash, and have inflation erode their purchasing power, or investing in a market endlessly reaching new highs. Major central banks have never been further behind the curve. Despite sharp rises in inflation, we have yet to see any of them raising short-term rates in 2021. Recent October U.S. CPI data reinforces the issue of inflation, hitting a three-decade high after increasing by 6.2% from one year ago:

Canada’s inflation is no different, accelerating to an 18-year high of 4.4% last month. Government of Canada 2-year bond yields rose from 0.52% to 1.09% – more than doubling last month.

There is a major disconnect between central bankers and treasury markets. Canadian rates are currently pricing six hikes by the end of 2022, while U.S. rates are pricing two hikes over the same time horizon. Meanwhile central banks have made it clear they are in no rush to raise rates in 2022.

With this divide, interest rate volatility has reached one-year highs and indices closed down on the month. Bloomberg reported that several large managers have experienced such bad losses that they lost confidence in their capabilities and halted trading altogether to contain the damage. We avoided this worst-case scenario as we continue to take a prudent, disciplined, and fundamentally-active approach to investing. We have the experience to trade wisely in any market environment, and during periods of extreme volatility we remain largely hedged, which has served our investors well.

THE FUND

We are pleased to announce that Amplus Credit Income Fund finished up +0.25% in October after costs. 2021 year-to-date growth is +10.48%. One of our top holdings, H&R REIT, saw credit spreads compress meaningfully by 10-15bps. They announced the early redemption of existing debt and released a strategic shift in their real-estate portfolio, exiting office and spinning out their retail portfolio to focus on multi-residential and industrial. This was well received by investors as it should improve their debt metrics. We used this opportunity to take profits on our investment.

GO FORWARD OUTLOOK

‘Don’t fight the Fed’ is an old saying that cautions us to align our strategy with the monetary policies of central banks. We view the probability of six hikes as low for two reasons:

- Canadian treasury markets are massive, currently at $1.2 trillion. To service this record high burden, by continuing to pump new debt into the market, central banks require investor confidence. Rising rates could be the straw that breaks the camel’s back.

- Servicing mortgage and household debt make up a large portion of budgets. If central banks hike rates too quickly, consumer spending will decrease significantly, slowing the economy.

Thank you for your support and interest in Amplus.